SBI Home Loan EMI Calculator Know Your EMI & Interest Amount Instantly 15th December 2022

Table of Content

He’s been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more. If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible's free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

For purposes of sections 24B, 80EE, and 80EEA of the Income Tax Act, as applicable, this certificate is required, in order to claim an income tax deduction for interest paid on a home loan. SBI easy home loan EMI calculator, by simply entering the loan amount, interest rate and select the loan tenure from drop down. For example, let’s consider you have availed a home loan of Rs. 60 Lakh at 9% (0.75% per month) rate of interest with tenure of 20 years .

How mortgage rates have changed over time

SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI. We will automatically post your comment and a link to the news story to your Facebook timeline at the same time it is posted on MailOnline. To do this we will link your MailOnline account with your Facebook account. As for those with savings they can afford to stash away for a year or more. At the start of November, the best one-year rates were as high as 4.65 per cent. That said, the top of This is Money's best buy savings tables has been a hive of activity, with new market-leading rates to report almost every week.

The repayment duration is the same as the tenure of the home loan as Equated Monthly Instalments . This is available to new home loan customers and also to existing home loan customers who have chosen the SBI Life Cover. State Bank of India gives attractive interest rates on home loans that start from 8.55% for a year. This tenure could be extended to a period of 30 years, and it also makes sure there is a comfortable repayment tenure. Even women borrowers are offered an interest rate concession, which would be a reduced interest rate of 0.5% on the State Bank of India home loans.

Even if a customer has enough money to buy a home, should one still consider an SBI Home Loan?

The customers who already have a home loan from SBI and want more money can take SBI top-up home loan. The money can be used for renovation/construction/extension or any other personal need. The product does not restrict the customer from availing Top up loan higher than the existing home loan. While calculating the EMI for a loan, you should know the amount which you will have to pay when you take up a loan of the said amount, the tenure, and also the interest rate. This will aid you in planning your finances prior to taking the loan so that your monthly budget does not take bear the burden! Another thing you can do is vary the parameters of the loan so as to reach the most suitable EMI as per your requirements.

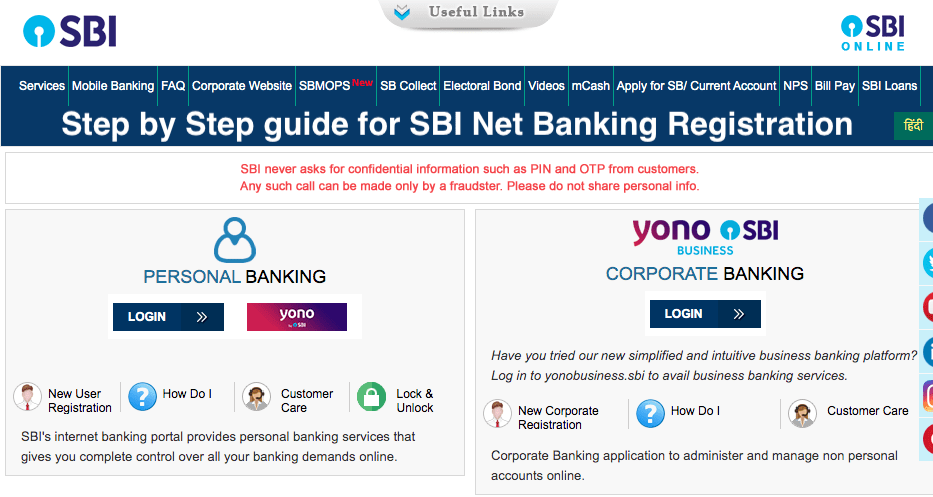

Some of the purposes for which an individual can apply for a home loan are new house construction, home renovation, purchase of an already built house. Some of the advantages and features that SBI home loans offer to home loan seekers are listed below. SBI home loan EMI calculator, borrowers can calculate their monthly installments before applying. You can avail pre-approved loans from SBI through their YONO App. It is to be noted that only pre-selected applicants who check off certain parameters are eligible to avail of this option.

SBI home loan interest certificate: Process to get SBI home loan statement online and offline

A part-payment would largely limit the liabilities when opted for at the right time. The SBI home loan part payment calculator enables a borrower to decide the overall profitability of the advance payment that they make against the housing loan liability. The maximum amount that you can apply for as a home loan from SBI, with a salary of INR 50,000 is around INR 34 lakhs approximately.

The maximum home loan tenure in SBI is up to a period of 30 years. However, the one that is offered at a lower interest rate and would cater your needs would be the best SBI home loan scheme for you. SBI provides home loans to salaried, self-employed, employees of central/state government, self-help groups and defense personnel belong to army, navy and air force. For your reference, below is the table showing SBI home loan eligibility. I further authorize Wishfin to obtain such information solely to confirm my identity and display my Consumer Credit Information to me.

Home Loan Calculator by Top Banks

Yes, you can download and print the certificate by visiting onlinesbi.com. Submit the form and copies of all relevant papers, such as your passport, PAN card, and Aadhaar card. The SBI Home Loan processing is transparent and involves no hidden charges. SBI has established its borrowing limit from 25 lakhs to 7 crores to cater to diverse customers with varying needs across the country. This is a type of home loan that is sanctioned even before the property has been finalized.

The SBI Home Loan calculator is available online and easily accessed from all electronic devices. The interested individual can easily access the calculator from the comfort of their homes utilising their free time. The calculator is based on a mathematical formula that provides you with an approximate figure that you may use as a reference point. This eliminates significant inaccuracies that might arise from manual calculations, which tend to be extremely time-consuming and inefficient.

You can calculate your home loan EMI almost instantly using the Home Loan Calculator. This calculator for Home Loan EMI might require just a few key home loan details from the user to display results. By using the SBI home loan EMI calculator SBI for 20 years, the EMI for Rs. 50 lakh loan for 20 years @ 7.90% p.a. Accurate Calculation – The use of the SBI home loan EMI calculator ensures accuracy.

This enables the borrowers to pre-plan and assess the EMI payment before deciding to take the home loan. The amount still owed on the loan will decrease if the borrower is able to prepay a portion of it. The bank will once more compute the EMI based on the remaining loan balance. This is the EMI that the borrower will be responsible for paying up until the interest rate is increased once more. Designed for the purchase of a plot of land on which to build your own home. Borrowing limits of up to Rs.15 crore are available, with repayment terms of up to 10 years.

The minimum processing amount for the loan would be from Rs. 2,000 to Rs. 10,000. This scheme is available for applicants that are aged from 18 years to 70 years of age. Part-payment of SBI home loan also facilitates in improving the borrower's credit score. The selection of the prepayment option would ensure easier principal repayment and also keep the interest accrual in proper check. The borrowers can also determine the overall saving that can be done with the help of the SBI home loan prepayment calculator.

This in essence lowers your effective rate of interest significantly. The successive rate rises mean that monthly mortgage payments will have risen by hundreds of pounds per month for some on variable rate deals or who need a new fix as their existing fixed rate has run out. So you can provide the same documentation to three different banks, and get offers with three different mortgage rates and fees that vary just as much. Borrowers may be able to save on interest costs by going with a 15-year fixed mortgage, as they often have a lower rate than that of a 30-year, fixed-rate home loan. But keep in mind that you’ll have higher monthly payments since you’re paying off your loan in half the time . Flexipay Home Loan is available for salaried and working professional/executives who apply for SBI home loan.

Comments

Post a Comment